ACCOUNTS PLAN

Companies must have a suitable chart of accounts and there are no provisions as to the contents and structure of a chart of accounts.

Only an outline provision stating that a company must have a chart of accounts designed for its individual requirements. This means that you are allowed to design your own account numbering.

The purpose of a chart of accounts is to secure a fixed structuring of the accounts created in the bookkeeping, used also for the treasury management.

Typically, the chart is structured like this:

- accounts concerning the day-to-day running of the company, shows the company’s earnings and expenses (profit and loss)

- asset accounts, shows the values in the company (assets)

- liability accounts, shows the debt/financing of the company (liabilities)

The program makes a standardized chart of accounts available; therefore, you just need to adjust it to suit your company’s specific requirements.

When you make an account plan for your company you need to know which activities you want to have information about. The shortest account plan you can make consists of two accounts:

000001 Income

000002 Expenses

If you only have these two accounts for registering information about your company’s economy, you will not be able to find out which activities are working well or badly. The only thing you can see is if the company in general is losing or making money. This is too little information for a modern project or company.

Consider carefully what information you need from your new business. The information you need should be shown in the account plan.

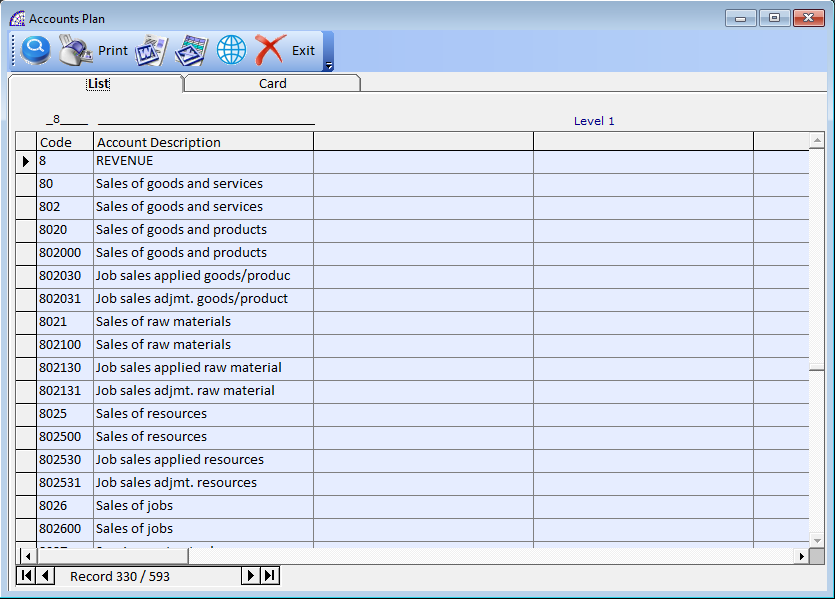

Each account has, besides its name, its own number. It makes it easier to work with in the daily tasks with the accounting or treasury data.![]() The program offers ten main levels, that you can look at pressing the relative command and selecting the “Level 1” option in the search conditions:

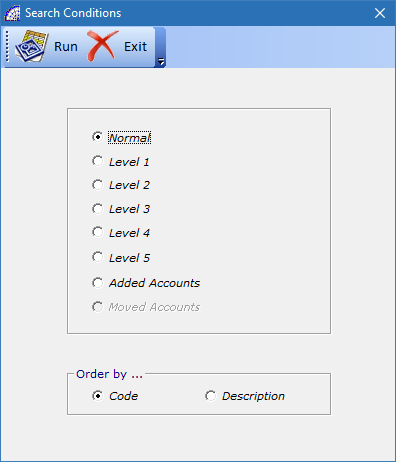

The program offers ten main levels, that you can look at pressing the relative command and selecting the “Level 1” option in the search conditions:

The displayed chart of accounts is the one used in the general accounting of the @/Arpro basic program, from where it is possible to intervene and personalize (in the base program @/Arpro, from the main menu select “Accounting” + “Accounts Plan”).

Consult the relative manual for more details.

The only thing that can be customized from this context, in sub-accounts with code “4” and length equal to 6 bits and corresponding to “MARKETABLE SECURITIES CASH”, is the “Account Type” field.

This field is available in the individual account form, by selecting the “Card” tab. By pushing the relevant combo-box, you can select a bank from the existing and pre-loaded ones (in the base program @/Arpro, from the main menu select “Bank” + “Bank Configuration”).

Whenever this specific account of the accounts plan will be moved in the general ledger, the program will generate a corresponding treasury movement with associated the selected resource (bank).

ACCOUNTING CAUSALS

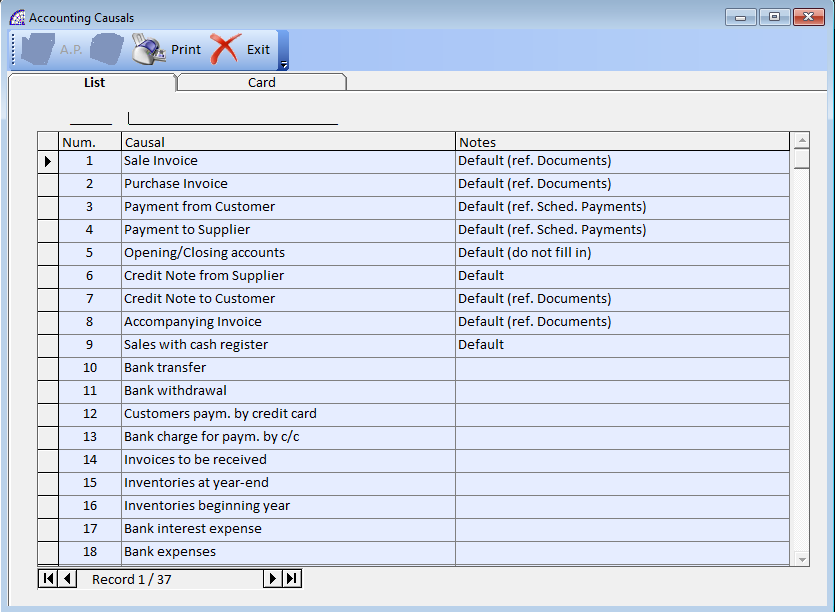

The accounting causals are an important tool for entering the accounting records entries in the general ledger.

Every single causal describes the accounting entry, it contains all the necessary information to create the automatism to generate the movement ledger: causal type, tax, accounts, etc.

The displayed causals are the ones used in the general accounting of the @/Arpro basic program, from where it is possible to intervene and personalize (in the base program @/Arpro, from the main menu select “Accounting” + “Accounting Causals”).

The program provides the main causals, others can be created and customized to complete all accounting needs. Consult the relative manual for more details.

In this context of the program it is necessary to insert the treasury causal, later described, thus creating a connection between the two different basic registries.

To insert the treasury causal press the “Card” tab from the relative accounting causal, press the “Treasury Causal” button and select from the available list.

TREASURY CAUSALS

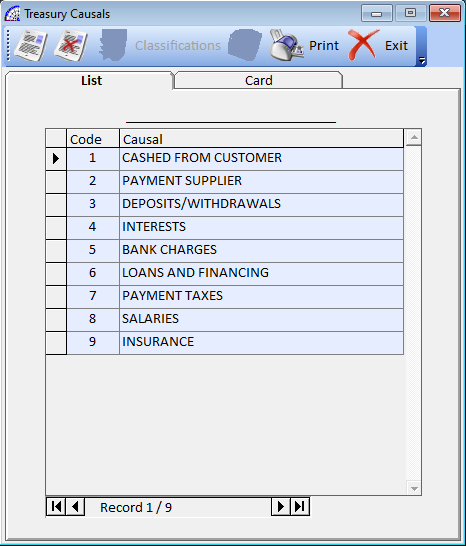

Similarly, to the general accounting, the treasury causals represent the basic constituent elements and to distinguish the treasury movements.

Each causal has its own description and a list of classifications; another basic and constituent element that makes it possible to create the automatisms for generating treasury movements as a result of corresponding accounting movements.

Each individual classification contains the references to costs and/or interests defined in the context of the banking conditions described below.

Toolbar

creates a new treasury causal.

deletes the selected causal, excluding the default ones from the operation.

allows to enter the various classifications by selecting them from the list of existing ones. The latter are described in the next section of this manual.

deletes the selected classification from the treasury causal.

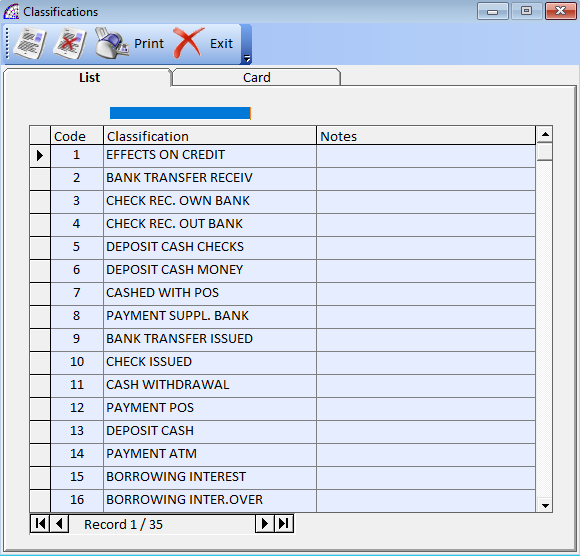

CLASSIFICATIONS

The last basic element structures the entire architecture of the @/Arpro TA program, Treasury Module.

Represents the master data details that must be included in the treasury causals, even more than one, to allow a definition of the details of costs and interests associated with the resource (bank).

The program makes a list available of the main ones used, others can be created for specific needs.

For each classification it is necessary to define beyond the basic description, the technical details: Rate, Currencies, Expenses-Costs.

Every single item contains a list of details in the relative combo-box, corresponding to the basic elements of the banking conditions described below.