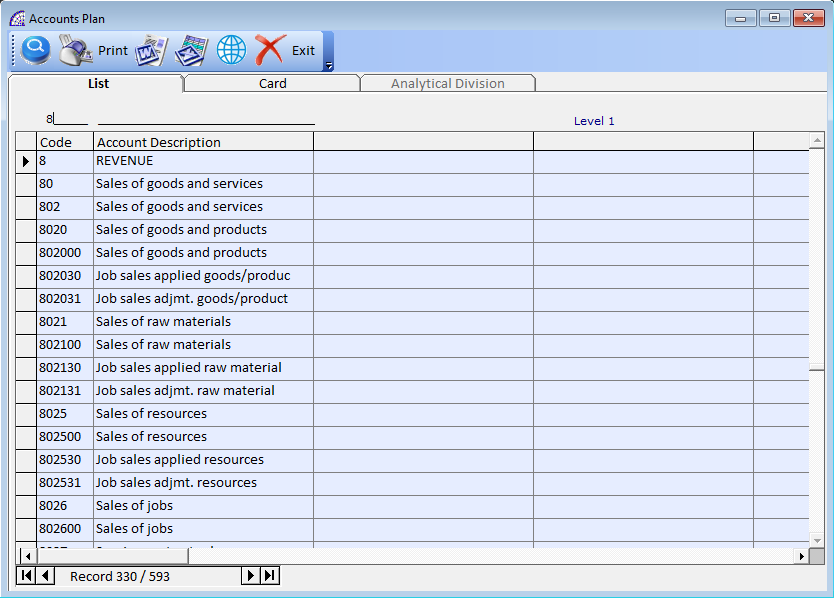

ACCOUNTS PLAN

n industry market, you will often find analytic accounts plans (charts of accounts) structured into departments and products the company itself is built on.

The objective is to examine the costs, sales and margins by department and by product. The first level of the structure comprises the different departments, and the lower levels represent the product ranges the company makes and sells.

Analytic account plans for an industrial manufacturing company could be structured in this way:

- Marketing Department

- Commercial Department

- Administrative Department

- Production Department

In daily use, it is useful to define the analytic account on each purchase invoice. The analytic account is the one to which the costs of that purchase should be allocated. When the invoice is created, it will automatically generate the entries for both the general and the corresponding analytic accounts. So, for each entry on the general accounts, there is at least one analytic entry that allocates costs to the department which incurred them.

Several costs are “direct” and easily assignable to a cost-center (Work Center), in this case the complete line is related to a single cost-center.

Many costs are “indirect”, when it is not possible to completely assign it to a cost- center (machine, department, employee, area, etc.) but is necessary to distribute them into a group of analytic accounts.

Sometimes the distribution is proportional, for example $120 into three analytic accounts correspond to $40 each. Other times the distribution is not proportional, and it is based on different criteria. Another typical example is the distribution of the rent cost in relation with the space each cost- center is using.

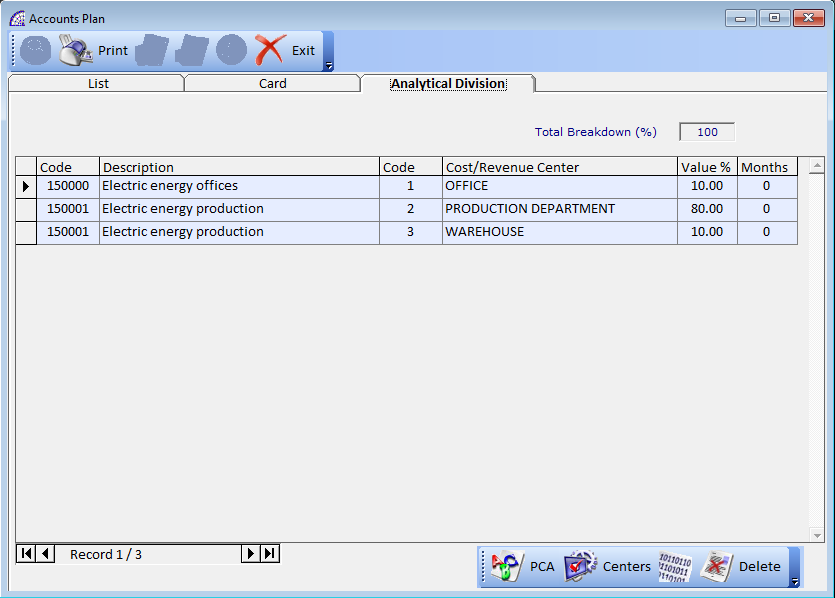

A typical example is the electricity cost. The cost is one amount that needs to be distributed between several areas or departments, each one with one %.

Sometimes we need to allocate indirect revenues to one or more cost-centers in different portions.

The program in this section provides a link to the general accounting plan, where you can customize the values. The 6-bit long account can establish a bond to the analytical plan, where in the “Analytical Division” tab it is possible to define the connection and the allocation indexes of the various accounts.

The amount on the “Total Breakdown %” field has to equal 100, so the values must then be allocated for each account entered in the underlying grid.

In the toolbar below are the command buttons to enter the various analytical accounts and the related cost or revenue centers to which they refer.

PCA: opens the list of analytical accounts loaded into the program.

Centers: opens the list of work centers loaded into the program.

adds a line of space in the account grid above the current cursor position.

deletes the record selected.

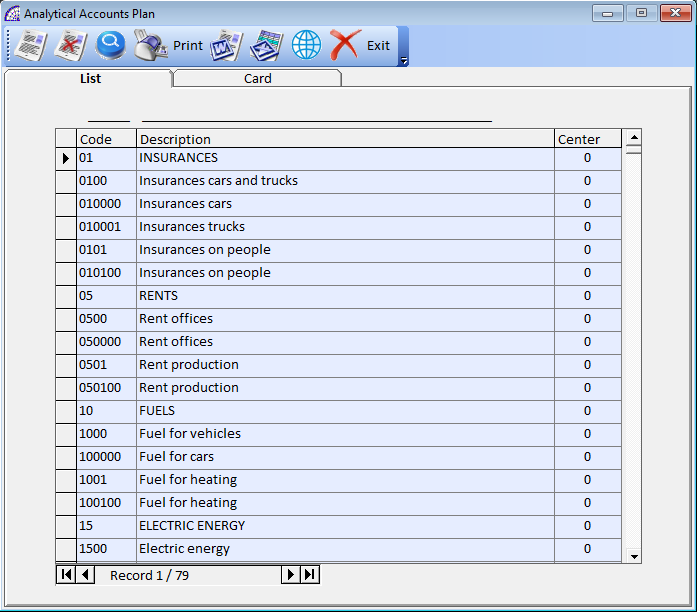

ANALYTICAL (COSTS AND REVENUES)

Like the general accounting, the definition of the analytical accounts plan represents the central part of the system and the level of detail to which it is intended.

Unlike general accounts, analytic accounts are not so much an accounting tool for accounts as a management tool for everyone in the company. That is why they are also called management accounts.

The main users of analytic accounts should be the directors, general managers and project managers. Analytic accounts make up a powerful tool that can be used in different ways. The trick is to create your own analytic structure for a chart of accounts that closely matches your company’s needs.

- Analytic records can be distinguished from general records by the following characteristics:

- they are not necessarily legal accounting documents

- they do not necessarily belong to an existing accounting period

- they are managed according to their date and not an accounting period

- they do not generate both a debit and a credit entry, but a positive amount (revenue) or a negative amount (cost).

The program provides an archive of general accounts, but these can be customized based on your needs. As already discussed in the previous section, they will then have to be linked and distributed in the various accounting accounts to which they refer.

Level 1, the main one, defines the backbone of the whole analytical architecture where the main costs and revenues are defined:

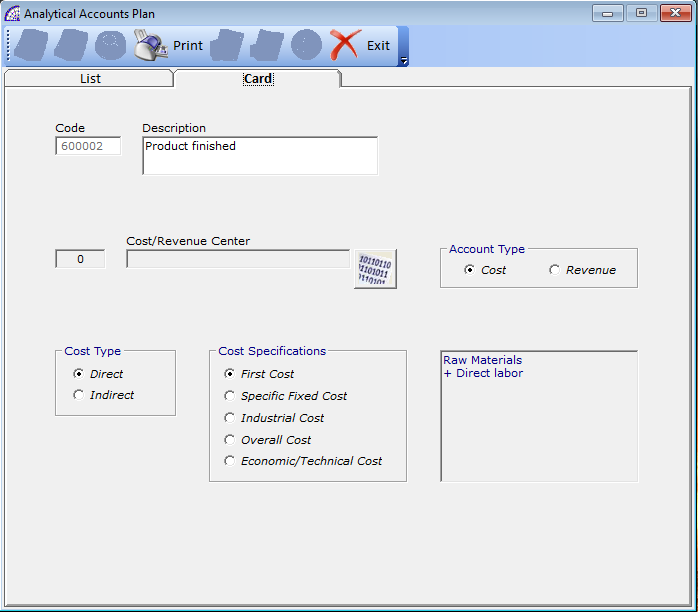

Every single account has a data sheet that defines its characteristics: cost or revenue center, account type, cost type, cost specifications.

The analytical accounts used in the context of movements are those with a length of 6 bits, even if they belong to a hierarchical tree structure.

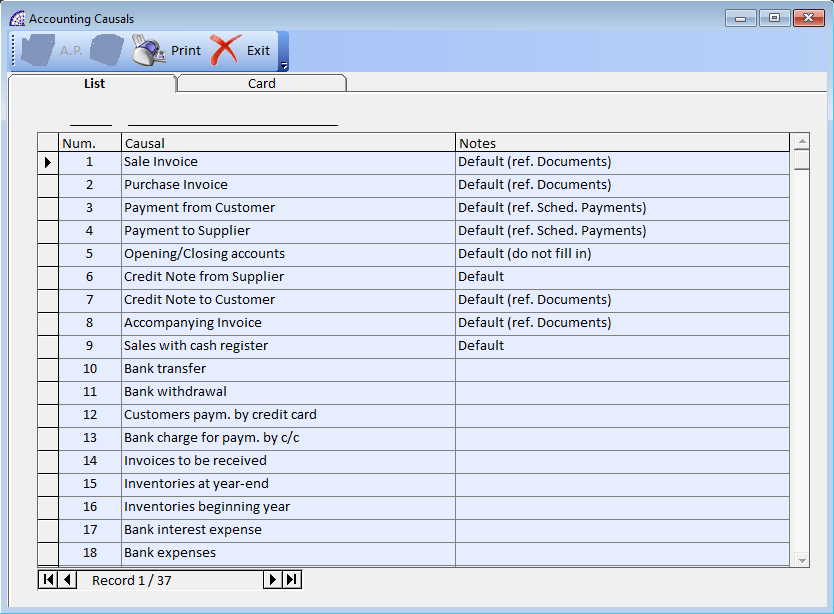

ACCOUNTING CAUSALS

The accounting causals are an important tool for entering the accounting record entries in the general ledger.

Every single causal describes the accounting entry, it contains all the necessary information to create the automatism to generate the movement ledger: causal type, tax, accounts, etc.

The displayed causals are the ones used in the general accounting of the @/Arpro basic program, from where it is possible to intervene and personalize (in the base program @/Arpro, from the main menu select “Accounting” + “Accounting Causals”).

The program provides the main causals, others can be created and customized to complete all accounting needs. Consult the relative manual for more details.

In this context of the program it is necessary to insert the analytic causal, later described, thus creating a connection between the two different basic registries.

It is necessary to select the accounting causal record, press the “Card” tab and select the available analytical causals from the list of after pressing the “Analytic Causal” button.

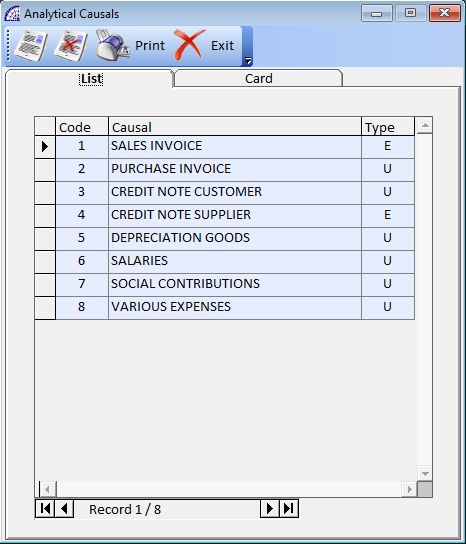

ANALYTICAL CAUSALS

Similarly, to the general accounting, the analytical causals represent the basic constituent elements and distinguishes the analytical movements.

Each causal has its own description and the definition of the type, income or expenses. Another basic and constituent element that makes it possible to create the automatisms for generating analytical movements as a result of corresponding accounting movements.

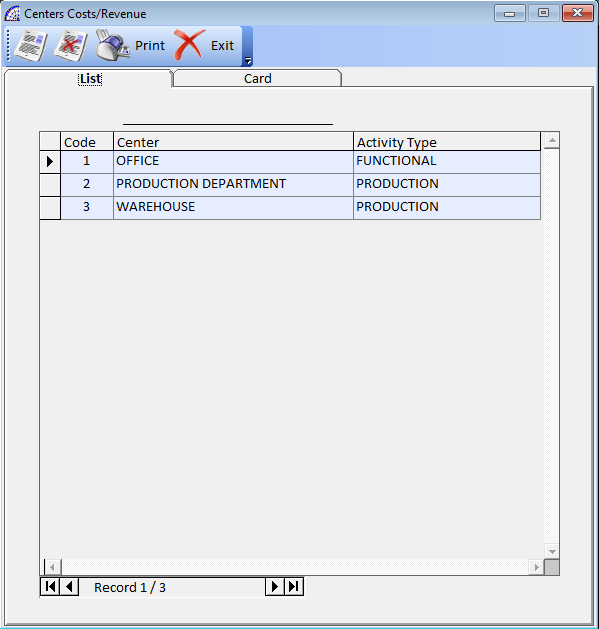

CENTER COSTS/REVENUE

A cost center is a business unit that incurs expenses or costs but doesn’t generate any revenue. Remembering that revenue is money from selling goods and services for the company. Examples of cost centers include accounting, human resources, and IT departments.

A revenue center is a distinct operating unit of a business that is responsible for generating sales. For example, a department store may consider each department within the store to be a revenue center, such as men’s shoes, women’ shoes, men’s clothes, women’s clothes, jewelry, and so forth.

A revenue center is judged solely on its ability to generate sales; it is not judged on the amount of costs incurred. Revenue centers are employed in organizations that are heavily sales focused.

To give an organizational structure that allows the program to provide a suitable control system, it must somehow integrate the creation of “Centers of Responsibility” (cost centers, revenue centers), for subsequent management and monitoring.

@/Arpro TA, Analytical Accounting Module allows for a structure that integrates the analytical accounting and management control creation.

Through “Responsibility Centers”, we can create an analytical framework that will correspond to a greater or lesser extent with a structure of “physical” items (shops retail, department stores) or more “conceptual” (corporate departments, business areas ), or combinations of both types of elements.

One of the most important phases in the implementation of management control using an organizational structure of this type, is the analysis which will define the most appropriate to your organizations structure.

The detailed elements present in the “Card” tab of the single record, define the type of center and its characteristics.

Code: is automatically assigned by the program, uniquely identifies the center.

Description: description of the center.

Center Type: defines if the center is really existing or a fictitious definition like to group a set of elements that do not conform or are defined in the area but that contribute to costs or revenues.

Center Manager: (optional) reference of the center manager.

Activity Type performed: defines the type of activity (Production, Auxiliary, Service, Functional).

Cubic Surface, Employees, Group: optional fields to give more details.