CUSTOMERS/SUPPLIERS

Select the command CUSTOMERS/SUPPLIERS, or the graphic icons ![]()

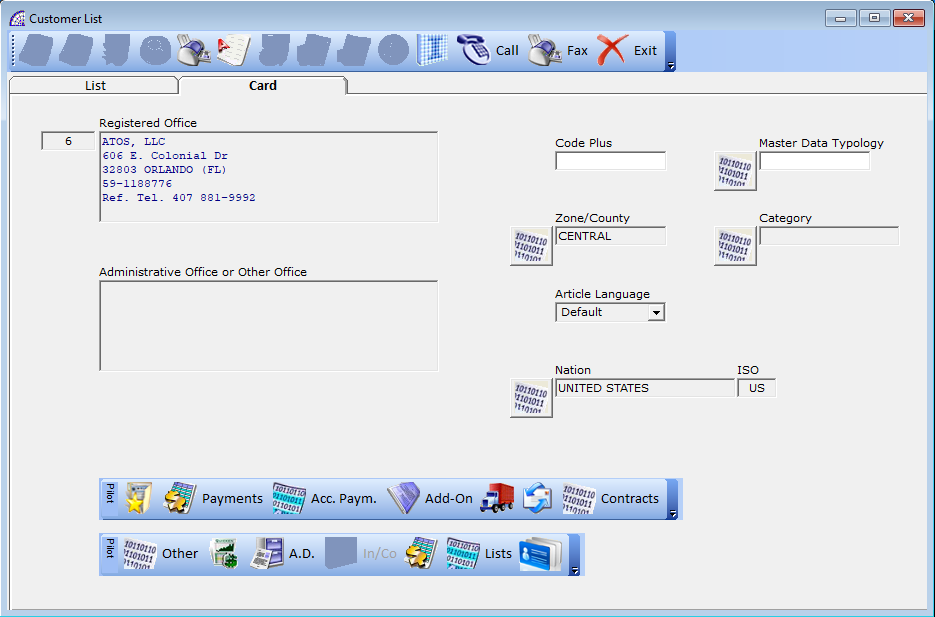

“List” card

“Envelope”: it permits to print the envelope with the customer data, if you print from the “List” tab, it prints the address of the Registered Office, from the “Card” tab, that of the other office (if present).

A drop-down menu appears where you can select or type the contact person. Press the button again to open the print module window and send to the printing device chosen.

The example mentioned refers to the printing of master data already present in @/Arpro. By selecting the registry item “ * MASTER DATA INEXISTENT * ”, a window will be displayed in the above-mentioned control where it will be possible to enter the specific data.

To print multiple envelopes at the same time use Automatic … + … Print Documents from the Documents menu.

duplicates the master data in customers or suppliers.

it is an internal notes field.

2nd note field: when a new document is created, the content is shown in the “Annotations” field (“Effects” + “Annotations”), it will be possible to print these texts by setting the function in the “Setting Modules” Form.

automatically dials the telephone number (if any), this procedure requires a connected modem and configured to the computer.

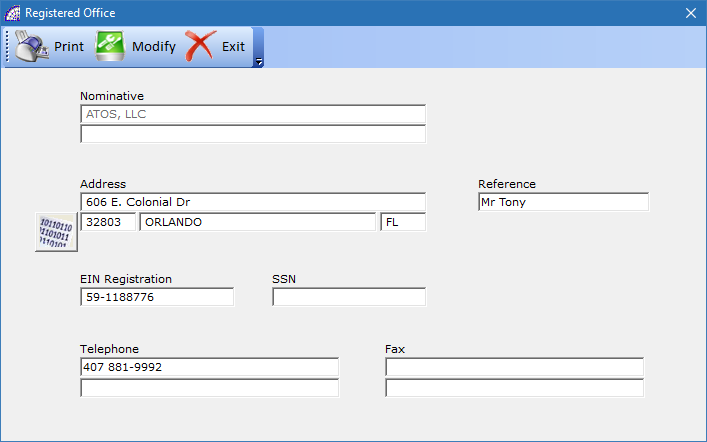

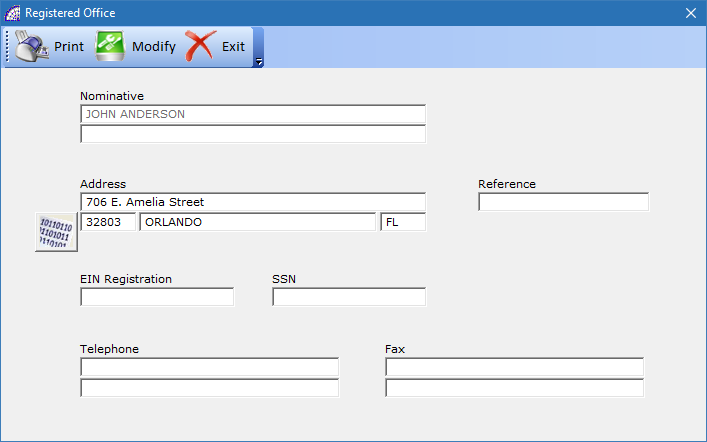

Double-click in the master data box to edit the data.

“Modify”: activates the modification of the company name field;

EIN Registration No. and SSN: if the master data is of Italian nationality, @/Arpro checks the authenticity of the data entered.

“Administrative office or Other Office”: manages another location, you can open it by double-clicking in the frame.

If “Administrative Office” is selected in the “Company Type” combo box, at the time of invoicing this address is shown in the “Destination” field of the document, if it is enabled to be printed (to verify, select from the main menu, “Settings” + “Setting Modules” + …).

If the invoice comes from another document (e.g. Transport Document or Customer Order by using the dedicated executing process), where a destination other than the “Administrative Office” was specified, it will be replaced by the administrative office, if any.

Only for “Administrative Office” the bank receipts, when printed on paper, displays this address by default (applies only to Italy).

“Code plus”: this is an additional customer code (optional), also useful for grouping in the automatic invoicing phase (from the main menu select “Documents” + “Automatic …” + “….. Sale Invoices”) of the various “Transport Documents” with the same plus code.

“Master Data Typology”: allows specifying the type of master data.

“Zone”: it is possible to divide the master data by area, especially useful for the management of commercial agents.

“Category”: field used to calculate the turnover and accrued commission of the agent. For more details see the section on the calculation of commissions and the management of agent master data (from the main menu select “Master Data” + “Agents”).

“Article language”: (optional) allows you to select the language of the description for the warehouse item when printing documents. For further clarification see warehouse articles.

“Nation”: important for the management of the “Accounting Records” and for the Intrastat module (only for Italy), it automatically proposes the nation “Italy”.

Toolbar

allows the management of multiple locations that can be selected for the destination field of the “Transport Documents” and “Accompanying Invoices” (from the Transport Document menu select “Card” tab + … button on the toolbar inside).

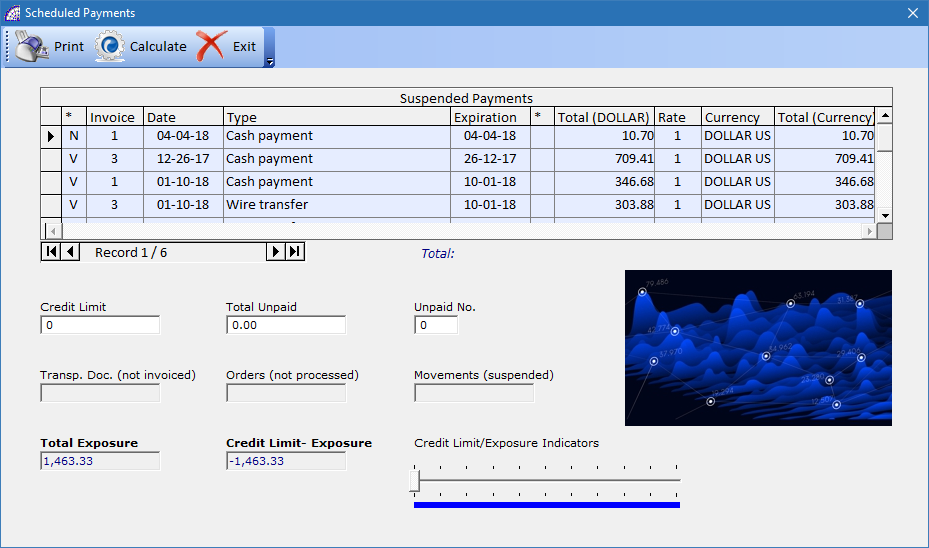

Payments:

“Credit Limit”: is the maximum exposure value granted to the customer or the supplier.

“Total Unpaid”: this is the total value of payment outstanding.

“Unpaid No.”: this is the number of outstanding payments.

“Transport Documents/Orders/Movements”: indicates the total value of each document that will still have to be invoiced.

“Total Exposure”: is the sum of all deadlines + transport documents + orders + movements.

“Credit Limit – Exposure”: it is the total “Credit Limit” minus the “Total Exposure”.

“Accounting Payments”

It allows the accounting management of the “Accounting Payments”. Please refer to the manual of the Accounting Records for a detailed description.

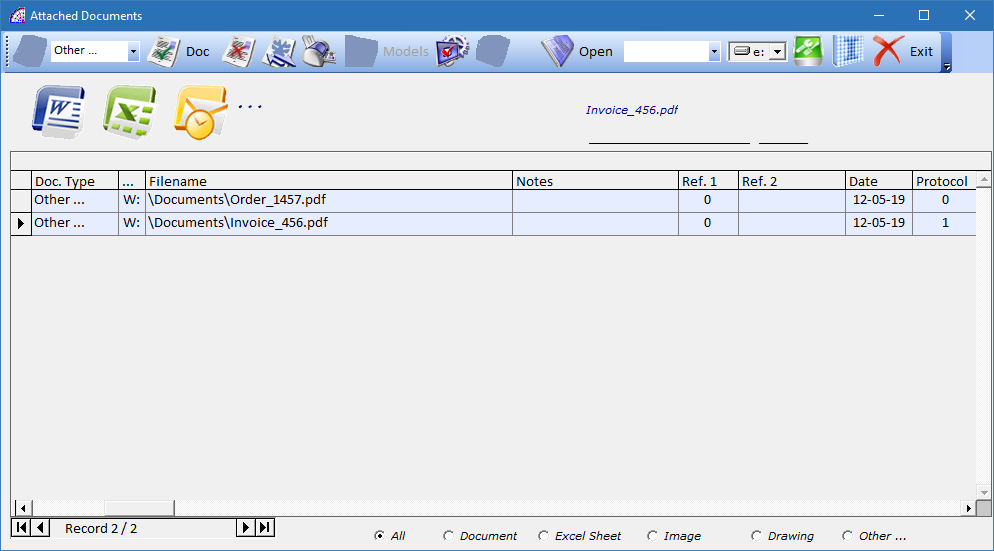

designed for the need to manage existing documents on external files, created by using the various existing programs on the Microsoft Windows® platform, connected directly to the currently selected resource.

allows the creation of a new document, after selecting the type from the 3 proposed in the combo-box list aside: “Document” for Microsoft Word®, “Excel Sheet” for the Microsoft Excel®, “Drawing” for Autodesk Autocad®.

The type of document created is copied from an existing template (Model.doc, Model.xls, Model.dwg), which can be customized with your own company logos and formatting: the templates are all saved in the following server folder \ArproW\Condivisa\Documents.

By selecting “Image” in the combo-box, instead of the document type, the program disables this button in the toolbar.

Pressing the open buttom, opens a window from where you select an external file in bitmap format (Bmp).

Once the file has been selected, as in the previous case of creating a document from an existing model, the program inserts a link in the grid below with all the necessary data.

Each record of the grid has a reference to the type of document (Doc. Type), a network drive (…), a complete path to the identification (Filename), an entry date (Date) and an automatically generated protocol number (Protocol). The remaining fields can be filled freely with data, even for identification: Notes (20 alphanumeric characters), Ref. 1 (numeric field), Ref. 2 (10 alphanumeric characters), etc.

Last operative choice but not least, is the possibility to select external files without format limits; selecting the “Other …” mode, as for the previous modes, the program activates the relative button.

This last choice is the most used to connect external files to the document management system (CRM), it represents the default.

deletes the link of the selected document, without removing the physical file on the disk.

The only condition that also allows the physical deletion of the external file, is if the latter was created by duplicating a model and it has been saved in the default folder mentioned above.

If active, by pressing the cancel or print button in the toolbar, the program operates on all the records visible in the grid (not only in the one currently selected).

sends the selected document to the printer, without opening it. It works only for Microsoft® Word® documents.

opens a management window dedicated to saving standard models, which can then be used in various contexts.

works only for Microsoft® Word® documents, activates the auto-compilation of the saved “Bookmarks” inside the specific document. The name of these “Bookmarks” must correspond to the name of the @/Arpro database fields, from which it automatically retrieves the data.

Organizing the various documents in standard templates available to the authorized network users of your company, is extremely time-saving and simplified by using this “Bookmarks” technology.

For more details, refer to the relative manual of the Microsoft Word® program (www.microsoft.com), regarding the “Bookmarks” management. For specific advice to define the whole context, contact our sales departments.

by double-clicking on the selected record or by pressing this button, the linked document will be opened. The system solves the problem of where the file is stored, if there are privileges from the operating system, and the file is opened by directly calling the creation program.

Any file format recognized by the Microsoft® Window® platform is opened, if the CRM module is correctly configured.

is a search filter, where you can select the various typologies Add-On from the list, and consequently the program displays all the documents that have associated that type.

Only during the insertion phase of a new document, if a type has been previously selected, the program associates it in the document as a search criterion.

Please consult the basic manual @/Arpro, regarding the specific management (from the program @/Arpro, in the main menu select “Master Data” + “Other” + “Typologies Add-On”).

defines the network unit that will be used, if different from the default one, when creating/inserting a new document in the CRM.

In the grid, the network unit associated with the document is displayed in the “…” column.

opens a configuration file with a defined record layout, which configures the CRM system to be able to open the various linked documents, in the different formats provided and recognized by the Microsoft Windows® platform.

The configuration file is saved on the local computer, in the \ArproW\ Altro\Arpro-crm.ini folder, considering that every PC on the network can have different configurations.

It is mandatory to respect the syntax of the file, which provides for each inserted record, then the recognized file format, a string with the file extension, a separation string consisting of the characters “–”, a complete path to open the corresponding program.

For any changes made, press the (Save) button on the toolbar at the bottom of the configuration window.

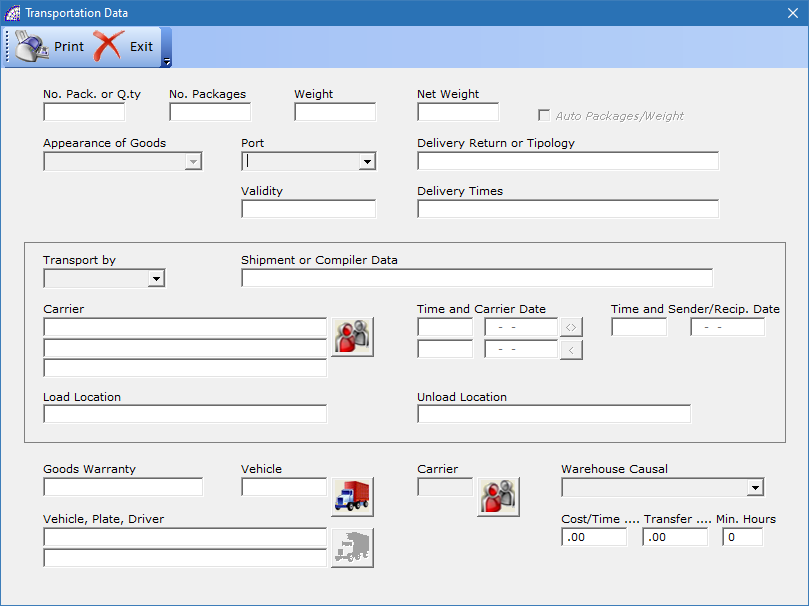

Contains all of the data concerning transport conditions; if completed, they are automatically reported in each delivery note or accompanying invoice or transport document of the program.

“Transport by”: indicate if the transport takes place via the “Sender”, “Recipient” or “Vector”.

“Port”: indicates if the transport takes place in “Free Port”, “Freight Forwarding”, “Freight Forwarding with debit”.

“Delivery Return or Typology”: indicates how the eventual return of any non-compliant goods takes place.

“Warehouse Causal”: applies only to “Transport Documents”.

If you set a warehouse’s causal as default, when the “Transport Document” is created, using this master data, the program automatically inserts this causal and warehouse items will be moved accordingly. By leaving this field empty the program uses causal No. 5, “Sale”, as default for the sales and causal No. 3, “Purchase”, for the purchases.

“Carrier”: if inserted, it is reported in all documents.

“Vehicle”: is managed with the “Attempted Sales Documents” module.

“Cost/Time … Transfer …. Min. Hours”: they are only indicative fields and are not managed by the program as calculations, but can be printed in the documents.

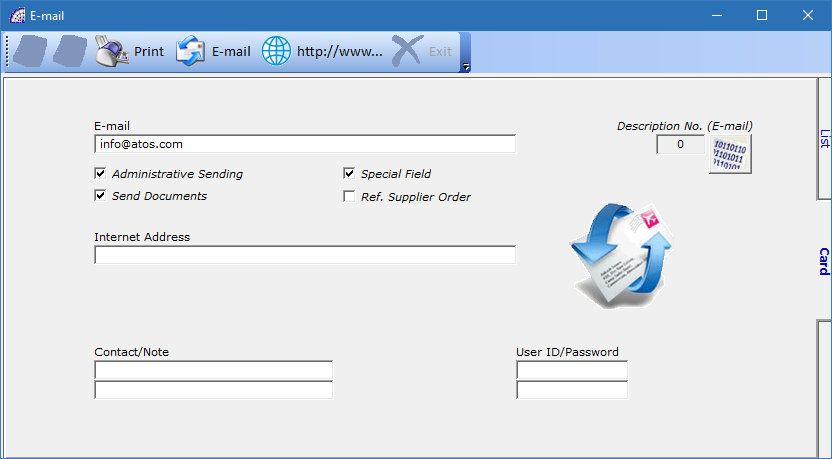

To manage all the emails of the single master data, also for the management of sending documents via email (invoices, transport documents, orders, quotes, etc).

“E-mail”: Pressing the button if a mail manager is configured, it directly opens a new message.

“Administrative Sending”: if active, it allows the management of the automatic sending of administrative documents (like invoices, credit notes, etc) by e-mail. “Sending documents”: if active, it allows the management of the automatic sending of documents by e-mail, excluding the administrative documents.

“http://www…”: if there is an internet address and a connection is available, pressing the icon opens the corresponding page.

“User ID/Password code”: enter the user code and password to access specific pages on the internet or to use an external ecommerce connected to the program.

Refer to E-mail from the Documents menu for more imformation.

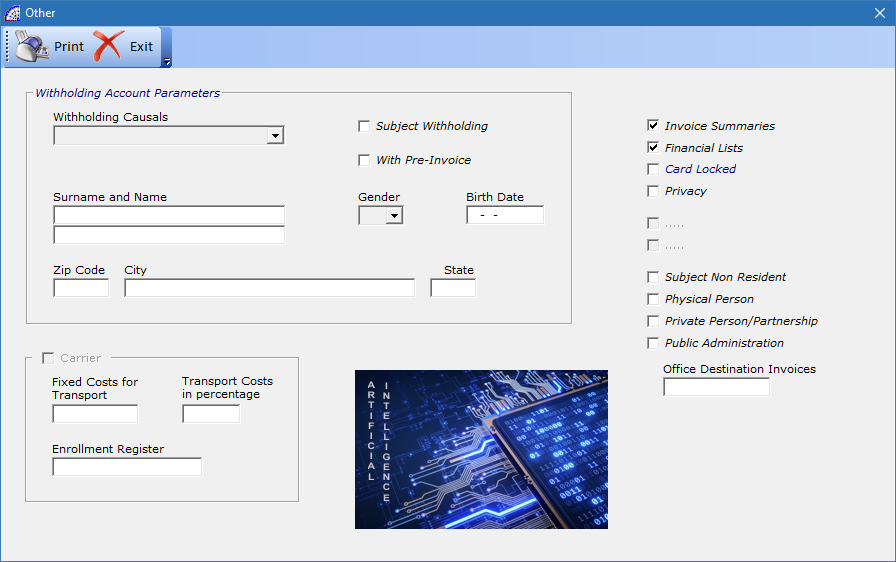

“Invoice Summaries”: at the time of invoicing from the menu, “Documents” + “Automatic …” + “….. Sales Invoices”, it activates the functionality of a summary of all the transport documents for the same customer and the selected period, on a single invoice.

“Financial lists”: accounting control for the creation of specific customer and supplier lists.

“Card locked”: lock the use of the master data for the creation of invoices, transport documents, orders, quotes, etc.

“Privacy”: privacy law; activate the flag if the master data has adhered to the processing of their company data.

“Subject non-resident”: accounting control for the creation of specific customer and supplier lists, if the subject is a non-resident.

“Physical person”: If the master data pertains to an individual.

“Private person/Partnership”: specifies if it is a private individual, an institution or a company, also used for the generation of specific customer and supplier lists.

“Withholding Account Parameters”

“Subject Withholding” by Suppliers: if the flag is active, during the creation of a purchase invoice, a movement is automatically created and registered in the management of withholding taxes.

It is mandatory to first set the withholding causal and to associate it with the master data (supplier). Please refer to the withholding tax manual for all of the necessary information.

“Subject Withholding” by Customers: if the flag is active, it allows to make sales invoices with withholding tax. It is mandatory to first set the parameters in the program configuration (“Settings” + “Configuration” + …). Please refer also to sales invoices.

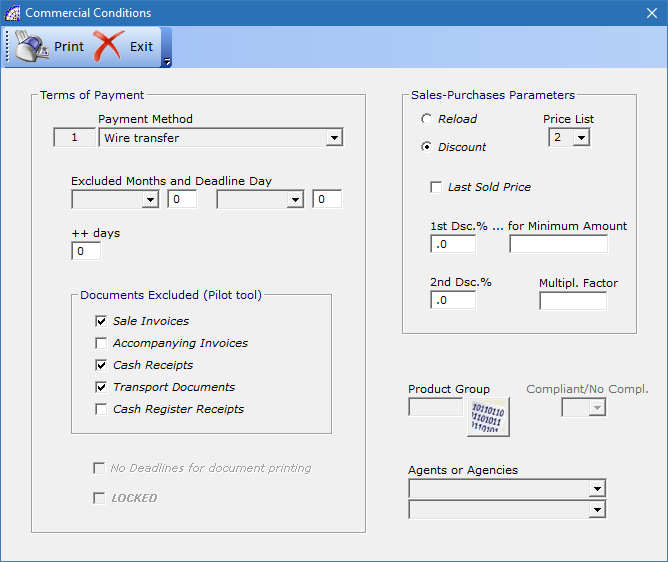

“Payment method”: to define the standard payment conditions for the master data. This is necessary to generate the deadlines in the “Sale and Purchase Scheduled Payments” and in the “Accounting Payments”.

“Excluded Months and Deadline Day”: used to automatically postpone any payment deadlines.

E.g. To skip the deadlines of August 31 to September 10, select August from the first drop-down menu and type 10, (days later), in the next field.

“++ days”: in addition to the previous management, a fixed number of days equal to the indicated value can be added to all payment deadlines.

“Documents excluded (Pilot tool)”: used in document management from the “Documents” + “Documents Management (Pilot)” menu, excludes the automatic creation of these documents for this master data.

“Sale-Purchase Parameters”

“Reload/Discount”: it only applies to customer master data and allows the management of sales for reload, starting from a purchase price; or for discount, starting from a list price (refer to the menu “Stock-Orders” + “Warehouse Articles” and consult the manual on the specific page).

This management is then applied automatically in all the documents the use customers as master data (sale invoices, transport documents, customer orders, quotes, job orders, etc).

“Price List”: indicates the sale/purchase list price to be associated with the master data. In the case of suppliers, 4 purchase price lists can be used, for customers 10 sales price lists (see warehouse articles).

“Latest Sale Prices …”: it is especially important for retail sales where similar prices have to be maintained compared to previous supplies.

If the check is active, during sales operations it stores the prices of the items for the selected customer. It tracks up to 5 prices for each item where the date of the operation and the quantity are shown together with the price. The prices displayed are easily selectable during the unloading of the articles in the sales documents.

“Multipl. Factor”: for customers only, enables the price calculation function by “multiplier factor”, in sales documents, compared to the purchase price or list price.

This management requires that the “Multipl. Factor” flag be activated in the program configuration (from the main menu select “Settings” + “Configuration” + “Variables” button from the toolbar). In addition, the warehouse article needs to be connected with a product group that has the same flag activated (from the main menu select “Master data” + “Other” + “Products Group”).

“1st Dsc.% … for the Major Invoice”: this is a global discount that is applied to sales documents (invoices, orders, quotes, etc), only when the taxable amount eventually discounted exceeds the value indicated in the field “for Major Invoice.

“2nd Dsc.%”: is applied to the total taxable amount of all sales documents. Generally, you make it correspond to the cash discount for payments on delivery of the goods.

“Product Group”: it can be connected to the master data.

“Agents or Agencies”: choose the name of the area representative (for more information see “Agents”). To delete this data you need to double-click in correspondence of the field.

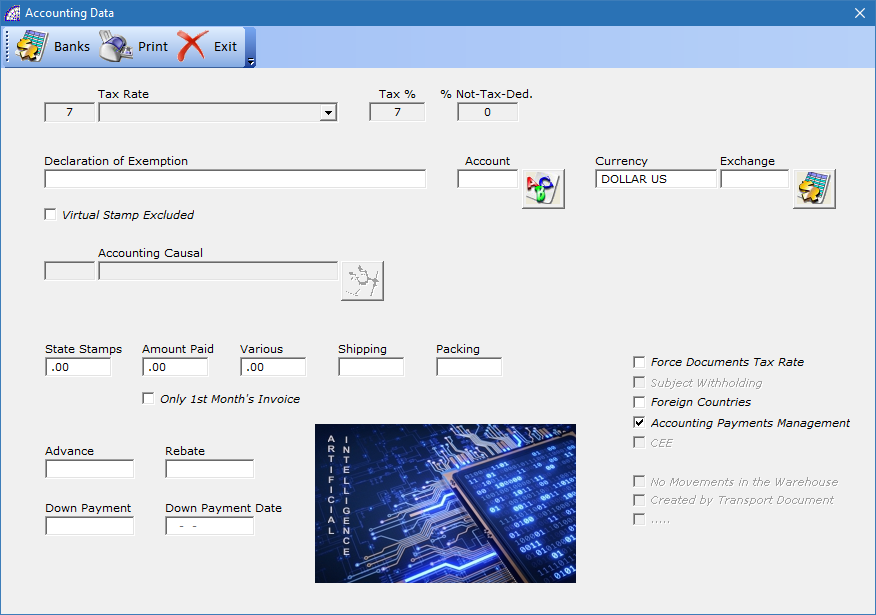

“Tax rate”: set the default “Tax rate” for the customer/supplier, it is automatically shown in the documents (invoices, transport documents, customer and supplier orders, quotes, job orders, etc).

“Declaration of exemption”: only for the customers who are Tax exempt (usually exporters), it is advisable to insert the references of the declaration, as well as to select the relative Tax rate as exempt.

“Account”: please refer to the manual of the Accounting Records for a detailed description.

“Currency”: automatically proposes the US Dollar as the currency (see the menu “Master data” + “Other” + “Currency”.

“State stamps, Cash, Various, Shipping, Packing”: it is possible to insert fixed cost values. These are then reported in each document that use this master data. It is possible at any time to modify the values in the specific document directly.

“Only 1st month’s invoice”: for the “Cash” expense apply the costs only to the first invoice of the month.

“Advance”: it is managed only by documents, by inserting an “advance value” in the payment deadline, the value will be subtracted from the document total.

“Rebate”: is managed only by documents, by inserting a “rebate value” in the payment deadline, the value will be subtracted from the document total.

“Earnest money” and “Date earnest money”: allows you to enter a value and the date of the “earnest money”.

“Force Documents Tax Rate”: The “Tax Rate” is present both in customer and supplier master data and in warehouse items, and it could be different for each one. The program, as the default value in the documents, uses the “Tax Rate” of the master data, except that in the configuration if the “Article Tax” flag is activated (from the main menu select “Settings” + “Configuration” + “Variables”).

In this case, to make sure that the document and the articles present in it, use the “Tax rate” of the master data selected, the flag in this form must be activated.

The additional costs of any “Cash”, “Various”, “Shipping”, “Packing” always show the “Tax Rate” of the master data (customer or supplier) unless in the “Defining Accounting Constraints” (Accounting menu), the setting is not forced.

“Subject Withholding”: indicates whether the document and therefore the master data is subject to withholding tax.

“Foreign Countries”: it is active only if the country is different from United States; it allows automatisms in the management of the “Accounting Records”.

“CEE”: indicates if the master data is part of the European community.

“No Moves the Warehouse”: only for documents, if activated and if you delete the whole document or just a few items inside it, the articles in the warehouse is not moved (uploaded or downloaded depending on the type of document).

“Created by transport document”: only for “Sales Invoices”, it is activated if the invoice has been generated by recalling one or more document transports.

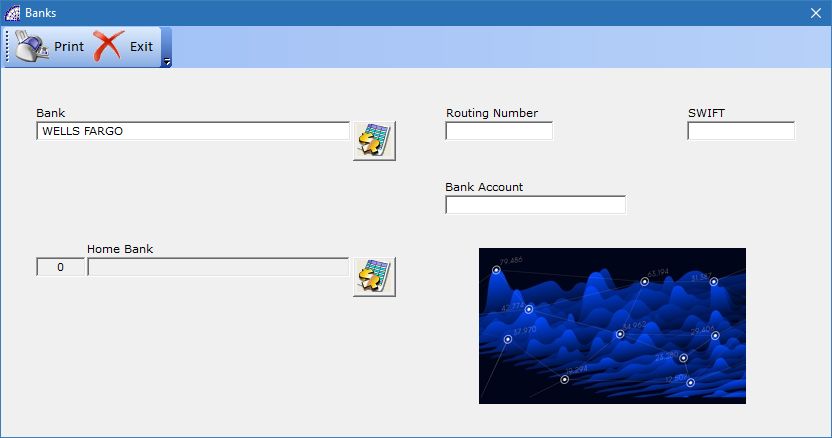

“Bank/Routing Number/BIC (SWIFT)/Bank Account”: are the customer/supplier bank references.

“Home Bank”: It represents its own collection bank. It will be possible to print this data in all of the forms: invoices, transport documents, etc. The bank must first be configured in the menu “Bank” + “Bank Configuration”.

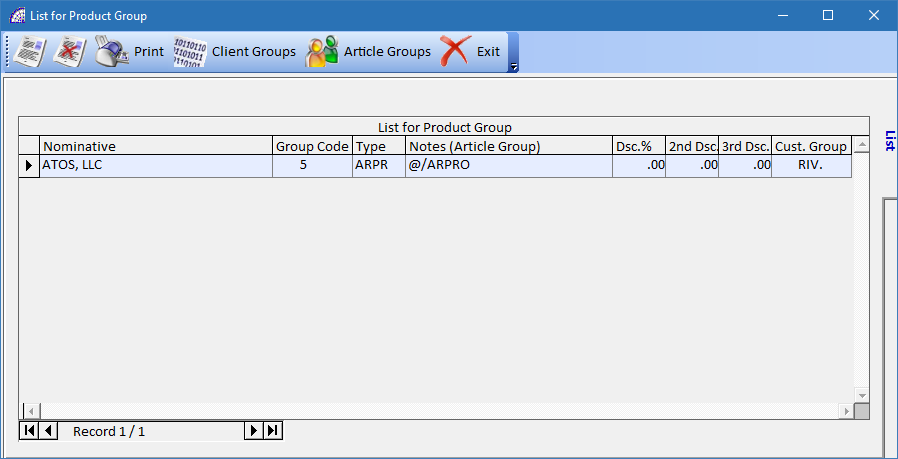

This allows the management of custom price lists for the customer’s product group and article’s product group. With the “” button a personalized price list is created and the customer’s name is automatically inserted.

“Article Groups”, “Client Groups”: with the “Article Groups” button the product group of the article is inserted; similarly with the “Client Groups” button the customer’s product group is inserted in the “Price List for Product Group”

When a sales document is created selecting an article from the warehouse button that has the same product group and customer reference inserted in the window “List for Product Group”, the program reports the discounts inserted in the same window.

Please note that any “Special Price List” present in the warehouse articles (from menu “Stock-Orders” + “Warehouse Articles”) have priority in these price lists for product group.

AGENTS

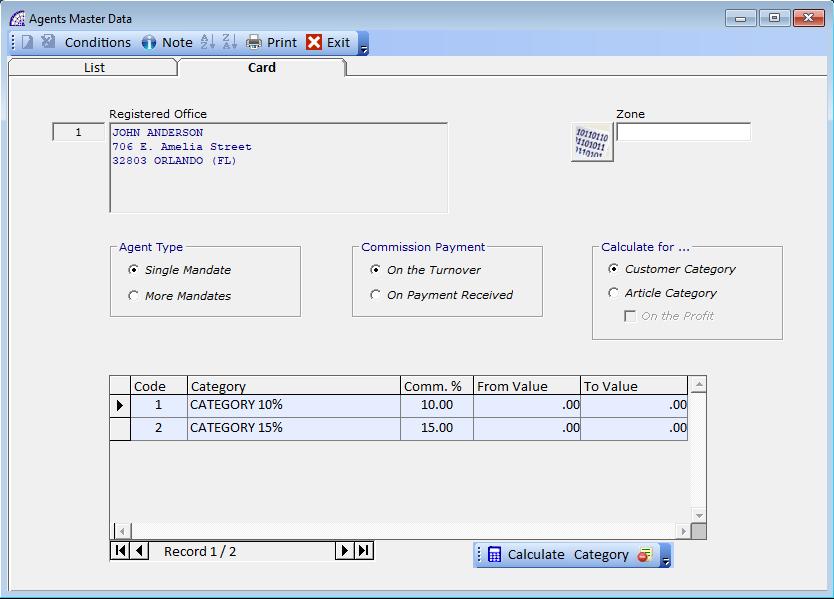

It manages the agent’s master data.

“Master Data Card”

“EIN Registration No.”, “SSN”: for both fields if the master data is of Italian nationality, @/Arpro checks the authenticity of the data entered.

“Zone”: indicates the area assigned to the agent to carry out his business.

“Agent type”: establishes the type of collaboration that exists with the agent. “Single mandate” the agent works only with the current company; “More mandates” the agent works with several companies.

“Commission Payment”: specifies if the commission calculation must be made on the turnover or on the payment received.

The first option considers the sales documents, the second the payment records of the “Accounting Records” from which it obtains the collected and registered payments (menu “Accounting” + “Accounting Records”).

“Calculate for …”: activating “Customer category” the agent’s commission will be calculated on the category of customer records; activating “Article category” it will be calculated on the category of warehouse items. For those who use the type of sale for “Reload” set in the customer’s master data (from menu “Master data” + “Customers” + “Card” + “Effects” + …), it can calculate the commission “on the profit”.

It is possible to exclude the agent’s commission in one or more rows of the articles within a sale document, by activating or deactivating the “No Commission” flag (from menu “Details”, within the document). To change the commission instead, press the “Category” button in the toolbar and select from the list the desired one or directly change the commission value in the grid.

“Toolbar (Buttom)”

“Calculate”: pressing the “![]() ” button calculates the total sales and accrued from the agent. It is calculated by adding up the amounts of sale invoices, accompanying invoices and invoice receipts, only where the agent is present with the conditions and percentages set in this window.

” button calculates the total sales and accrued from the agent. It is calculated by adding up the amounts of sale invoices, accompanying invoices and invoice receipts, only where the agent is present with the conditions and percentages set in this window.

The amount of the total sales and accrued are reported on the “Conditions” card, in the “Total Turnover” and “Accrued” field.

“Category”: enter the categories with the respective commission percentage values. The categories must first be created and defined in the various percentages (from menu “Master data” + “Other” + “Categories”.

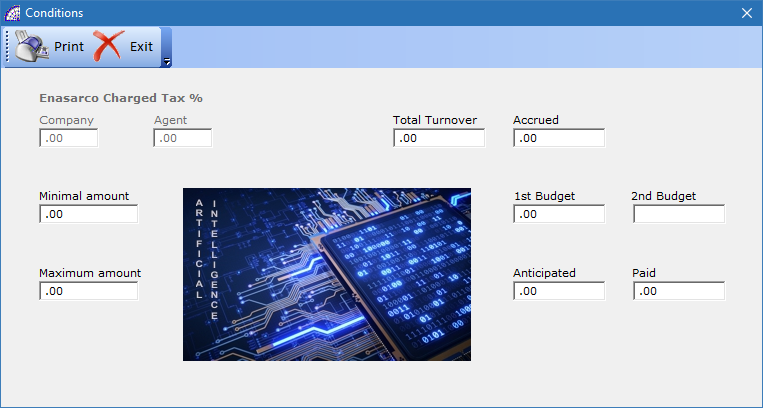

“Conditions Card”

“Enasarco charged Tax %”: enter the percentages of Enasarco in the field “Company”, “Agent”, “Minimal amount”, “Maximum amount”.

“Accrued”: by pressing the ![]() button you get the amount for the agent that is calculated according to the conditions and the set percentages.

button you get the amount for the agent that is calculated according to the conditions and the set percentages.

“1st Budget”, “2nd Budget”: specify the budget imposed on the agent.

“Anticipated”, “Paid”: specifies the value already paid to the agent.

“Prints available on the List tab”

“Print Preview”: prints a report with the list of agents.

“Customer of Agents”: reports the detailed list of customer data by agent.

“Agents Categories”: for each agent it reports all of the categories for the commission calculation.

“Prints available on the Card tab”

“Print Preview”: reports a print with the list of agents.

“Agents Turnover”: is the list of commissions.

“Customer of Agents”: reports the detailed list of customer data by agent.

CARRIERS

Creates the master data of the carriers. See the customer/supplier details for further information. The carrier also appears in the supplier lists.

PAYMENTS

![]() create a new type of payment.

create a new type of payment.

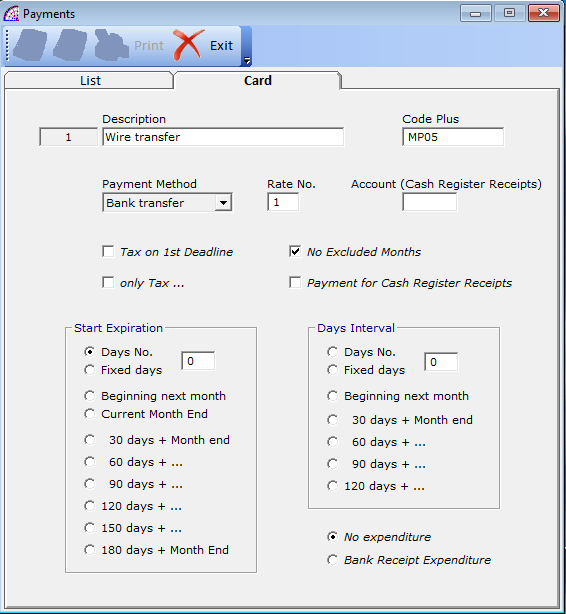

“Description”: is the description that appears in the documents and in the “scheduled payments” (from menu “Documents” + “Scheduled Payments” + “….. Sales” or “….. Purchases”).

“Code plus”: additional free field also used to group the different payments or to establish a relation with other business management software that use different codes, to share data.

“Account (Cash Register Receipts)”: manages the “Accounting account” in the “Accounting Card” of the “Cash Register Receipt”. To find the “Accounting Card” open the menu “Documents” + “Cash Register Receipts” + “A.D.” button in the toolbar.

“Payment method”: set the type of payment, useful for searches in the “Scheduled Payments” but only if “Bank Receipt” allows the automatic creation of them.

“Rate No.”: indicate the number of payment rate (installments from 1 to 99).

“Tax on 1st Deadline”: inserts the entire Tax amount in the first expiry rate (installment) of the payment.

“Only Tax …”: inserts only the Tax in the expiry rate (installment), the taxable amount in the subsequent ones.

“No Excluded Months”: if active, it does not consider the excluded months set in the master data of customers, suppliers.

“Start Expiration (first payment deadline)”

“Days No.”: is the number of days from the invoice date.

“Fixed days”: it’s a fixed day of the month.

“Beginning next month”: expiry on the first of the following month.

“End this month”: expiry on the last day of the current month.

“30/60/90/… days”: for deadlines at the end of the month.

“Days interval”

If the payment has more than one expiry rate (installment), indicate the constant interval (expressed in days) of the subsequent expiry rates (installment) from the first one.

“Bank Receipt expenditure”: if active, you can add bank charges automatically on the invoice (included in the customer details and only for payments with “Bank Receipt”).

TAX RATE

It is possible to create other Tax rates, @/Arpro already prepares some of them. These Tax rates will be used in the customer/supplier master data and in all fiscal and “Accounting Records” documents.

PACKAGING TYPE

Used in transport documents and in accompanying invoices.

A list of packaging types already entered appears, it is possible to modify their description, delete them or insert new ones.

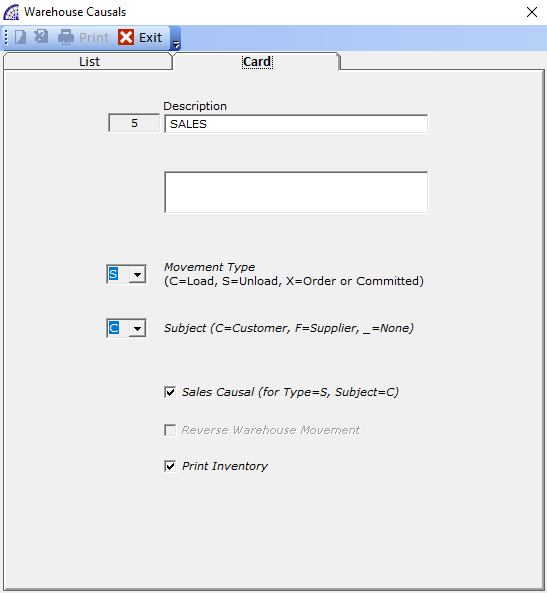

WAREHOUSE CAUSALS

Used in all warehouse movements, transport documents, accompanying invoices, etc.; they are necessary to establish the type of warehouse handling: loads, discharges, commitments to customers, orders to suppliers, production commitments.

All of these operations are defined by the two operating parameters: “Movement type” and “Subject”.

A list of warehouse causals already entered appears, you can enter new ones. Some of these causals if used in the movements of the warehouse, allow the creation of a “reverse movement”. For further clarification see the motives of reverse movements in warehouse movements.

The “Sales Causal” flag is used in for @/Arpro automatic operations, such as the creation of sales invoices by Transport Documents, with the “Auto-Sale Invoices” procedure (from the menu “Documents” + “Automatic …” + “… Sale Invoices”).

This flag is needed to inform the program that the document uses a causal for unloading the warehouse, per customer, so it is a sale movement. In the default causals the flag has already been activated where necessary, in those created by the user it will have to be activated instead.

NATIONS / ZONE / STATES / CITIES / CATEGORIES / CURRENCY / VARIANTS / BRANDS /…

They are used to specify the master data in more detail and make it possible to perform search conditions on the data.

A separate consideration needs to be made with regard to the categories alone. Also used for statistical operations, they allow the management and calculation of the turnover and accrual of the agent. See Agents for more detailed information.

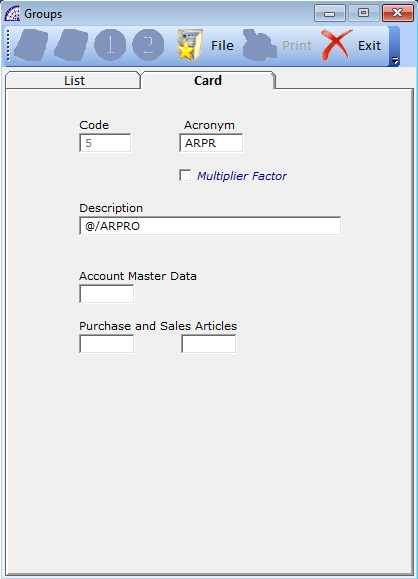

PRODUCTS GROUP

Optionally used to catalog invoices, movements, delivery notes, product families, geographical areas, etc.

“Acronym”: is the code that is displayed in the warehouse articles.

“Multiplier Factor”: to be activated only for articles that will be sold not for price list or “reload method”, but for multiplier factor. See also “Warehouse Articles”.

“Accounts Master Data”, “Purchase and Sale Articles”: see the manual of the “Accounting Records” for a detailed explanation.

VARIANT 1, VARIANT 2

This is one more possibility offered by @/Arpro in the management of warehouse articles where, together with the unique code, an additional value is needed that defines the variants. These can be, for example, size or color in the textile sector.

Before using the variants it is necessary to have them created in the master data. See “Warehouse Articles” (from menu “Stock-Orders”) and “Configuration” (from menu “Settings”) for a more detailed description.

FIDELITY CARDS

See the explanation in the “Cash Register Receipts” (from menu “Documents”).